There’s an old saying that the stock market goes up like an escalator and down like an elevator. There haven’t been too many weeks in which this was more true than this one. Unless you’ve been in a cave with no TV, you’re aware of the steep market selloff due Read More…

Blog

Tax Changes Coming (Probably)

Federal IRA and Ohio Business Deduction Proposals May 9, 2019 When tax law changes are being discussed, we typically take the approach of waiting to see what’s in the final law before wasting too much time evaluating what is being discussed. This is because there can and likely will be Read More…

How Long Do You Plan To Live?

Clients love when we talk about how long they are going to live. Don’t they? Probably a fair share would rather be having a root canal done than having this discussion. But it’s an important question. When someone asks how much they need for retirement, the answer is easy – Read More…

Book Review: The Bogleheads’ Guide to the Three-Fund Portfolio

This article may resemble a plump turkey writing about how to prepare a perfect Thanksgiving dinner (and I appreciate limiting further comparisons of the writer to a turkey). I am writing to review a book I recently finished – The Bogleheads’ Guide to the Three-Fund Portfolio. The author is part Read More…

Market Update

The global stock markets have declined significantly during the fourth quarter (see below) and just ended a particularly poor week. This week began with additional declines as we write this just prior to the close today. There are numerous culprits for the recent selloff (federal reserve, slower global economic growth, Read More…

The (Moderately) Terrible, Horrible, No Good, Very Bad Capital Markets

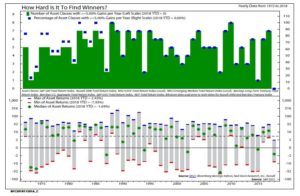

I found the chart below (from Ned Davis Research NDR.com) to be fascinating. It is a chart that only a financial nerd would love but I’ll explain more. OK, so there’s a lot going on here (too much some might say). But I think it does a very good job Read More…

Diversification Means Always Having To Say You’re Sorry

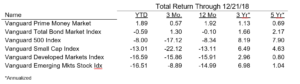

The S&P 500 is up 6.4% this year through 7/31/18. Great news, right? Yes if you were primarily invested in a S&P 500 Index fund. Even better if you are tilted toward U.S. growth stocks. If invested elsewhere, not so much. The following chart shows the year to date returns Read More…

IRS Scams

Included below is information from the IRS regarding recent new scams. This has been an increasing problem in recent years. A general guideline I heard at a recent conference was: If the IRS calls you, hang up. If the IRS emails you, ignore it. Their customer service is not that Read More…

Market Comments 2/6/2018

Stock markets started the year with an accelerated continuation of the one way staircase higher that they enjoyed in 2017 (see separate “February 2018 Monthly Market Update”). This period was marked by numerous records being broken for the longest period without even a 3% drop. Then, things changed rather quickly. Read More…

Equifax Breach – What We Are Doing

There has been a multitude of articles in recent days discussing the detail of the Equifax data breach as well as what steps consumers might take resulting from the breach. This isn’t one of those articles. Linked below are several such articles. The purpose of this article is to briefly Read More…